The competitive landscape of UK insurance broking is once again being reshaped by a familiar and formidable force, as private equity firm Inflexion signals its intent to build a new national powerhouse from the ground up. This decisive return to a sector it knows intimately is not just another

A New Era of Agility in Insurance Technology Executing a full-scale digital platform launch in the time it typically takes for a single business quarter to pass was once considered an impossible feat within the deliberate world of insurance. Yet, Santam has fundamentally altered this perception by

A significant wave of market consolidation, marked by four major deals, is fundamentally reshaping the technology priorities for UK insurers, compelling a strategic pivot toward complex post-merger integration and large-scale data migration. This intense focus on combining disparate corporate

A single automated decision in the insurance world can alter a person's life, a reality that places the industry's rapid technological adoption in a delicate balance with its foundational need for trust. As artificial intelligence moves from a theoretical advantage to an operational necessity, a

Beyond the Bottom Line Why a £2 Billion Renewal Is Reshaping Specialist Motor Insurance A handshake valued at over two billion pounds does far more than just secure capital; it forges a new standard for strategic alliances within the specialist insurance landscape. The recent renewal between KGM

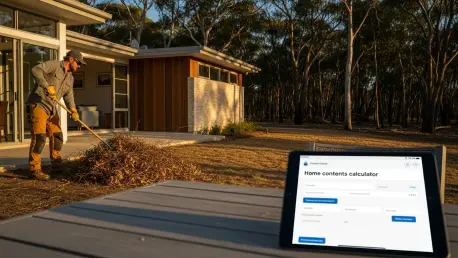

As the familiar rhythm of the seasons gives way to longer, more intense periods of extreme heat, the risk of catastrophic fire is no longer a distant threat for a few but an encroaching reality for millions. Major insurers across the nation are now sounding a clear and urgent alarm, compelling