The familiar advice for weight loss has long centered on diligent calorie counting and rigorous exercise, yet a small, sophisticated sensor worn on the arm is quietly rewriting the rules of personal health management. This technology, once confined to the clinical management of diabetes, now offers

For millions of insured Americans, the journey to receiving prescribed medical care has become a frustrating maze of administrative hurdles, and a recent comprehensive poll reveals that the single greatest non-cost-related obstacle is the process of securing prior authorization. This requirement

The world of smartwatch customization has a new benchmark for excellence. Facer, a leading platform for watch face design, has officially unveiled the winners of its inaugural ‘Facer Awards,’ a landmark event celebrating the most creative, functional, and popular designs of 2025. This celebration

The true measure of a fitness tracker's success lies not just in the data it collects but in its ability to translate that information into sustained, meaningful user motivation. Recognizing this, Zepp Health has introduced a significant update for its Zepp companion app, the software hub for

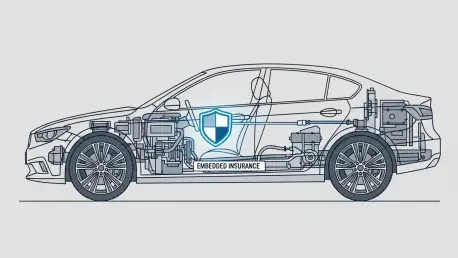

The long-standing promise that advanced driver-assistance systems would not only enhance safety but also deliver tangible financial benefits to vehicle owners is now becoming a reality. For years, the conversation around features like Tesla's Full Self-Driving (FSD) has centered on capability and

The rapidly evolving landscape of the automotive industry is forcing a profound reimagination of traditional car insurance, where real-time vehicle data is becoming the cornerstone of risk assessment and customer engagement. In a significant move that underscores this trend, insurance giant Allianz