Beyond the Bottom Line Why a £2 Billion Renewal Is Reshaping Specialist Motor Insurance A handshake valued at over two billion pounds does far more than just secure capital; it forges a new standard for strategic alliances within the specialist insurance landscape. The recent renewal between KGM

The landscape of construction insurance across the western United States is undergoing a seismic shift, a period of intense pressure that industry experts have aptly termed a reckoning, fundamentally altering the operational norms for developers, contractors, and insurers alike. This crisis is not

The escalating pressure on insurance underwriters to deliver faster, more accurate decisions in an environment of growing risk complexity has pushed traditional, fragmented systems well beyond their functional limits. This article examines the critical need for insurers, carriers, and Managing

As the insurance industry grapples with the escalating frequency and severity of climate-related disasters, a fundamental shift is underway, moving beyond reactive modeling to proactive, AI-driven risk integration at the very core of underwriting. The traditional approach of assessing climate

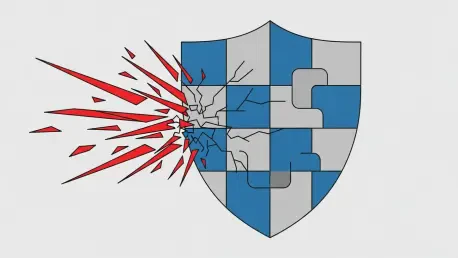

The foundational principles that once made digital risk a manageable, insurable commodity are now being systematically dismantled by the relentless advance of artificial intelligence-powered cyberattacks. What the industry is currently facing is not merely an incremental increase in threat

The underwriting department often stands as a company's most significant operational bottleneck, where talented professionals are consumed by tasks that offer minimal strategic value, such as manual data entry, exhaustive document reviews, and the redundant cross-referencing of existing