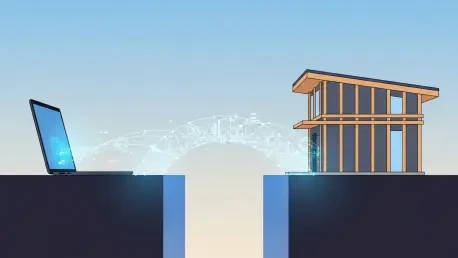

For countless homeowners with properties that defy the standard checkboxes—from unique construction materials to a past history of subsidence—the search for insurance has long been a frustrating journey into a digital dead end. In a world where nearly every service is available with a few clicks,

Beneath the surface of daily market fluctuations, a fundamental reshaping of the UK insurance industry is quietly underway, with leading firms moving beyond incremental changes to redefine their core strategies for long-term success. Beyond the Headlines: Decoding the New Blueprint for UK Insurance

With over two decades of experience spanning traditional insurance giants and agile Insurtech startups, Simon Glairy has a unique vantage point on the industry's evolution. His expertise in AI-driven risk assessment and digital transformation makes him the ideal voice to deconstruct one of the

The latest financial disclosure from Niva Bupa Health Insurance presents a compelling yet concerning paradox for the market, showcasing a company experiencing vigorous expansion while simultaneously struggling to achieve profitability. This situation is encapsulated in its recent earnings report,

The traditionally paper-intensive and often cumbersome process of securing motor insurance in Kuwait is facing an unprecedented digital challenger, not from a legacy insurer, but from an unexpected player in the nation's telecommunications sector. The launch of Zain Insure, a fully digital platform

In an era where a single cyberattack can cripple a multinational corporation, the insurance industry faces the monumental task of accurately pricing a risk that is constantly evolving, expanding, and becoming more sophisticated. The expanded partnership between Verisk and KYND aims to tackle this