The longstanding model of home insurance, traditionally defined by a reactive cycle of assessing damage and issuing payments after a disaster, is undergoing a profound and technologically driven evolution. This fundamental change pivots the industry’s focus away from simple indemnification and toward proactive loss prevention, a strategy made possible by the widespread adoption of smart home devices and the Internet of Things (IoT). Insurers are increasingly incentivizing homeowners to install connected sensors that can detect and mitigate common household hazards—such as water leaks, fires, and unauthorized entry—in real time. This is not merely a trend but a structural realignment of the insurance product itself, aimed at curbing the rising frequency and severity of claims, stabilizing operational costs, and ultimately redefining the relationship between the insurer and the policyholder into a continuous partnership in risk management.

A New Model for Risk Management

From Reactive to Proactive

The traditional underwriting process has long been anchored in historical data, assessing a property’s risk based on past claims, location, and static characteristics like construction materials. This method provides a snapshot in time but fails to account for the dynamic nature of risk. The new model, empowered by an array of smart sensors, introduces a continuous and dynamic approach to risk monitoring. It transforms the home into a data-rich environment, providing both homeowners and insurers with a live feed of its condition. This real-time visibility allows for immediate intervention at the first sign of trouble. For instance, a small, slow leak from a washing machine hose—an issue that might go unnoticed for days and result in catastrophic water damage—can now trigger an instant alert to a homeowner’s smartphone and, in some systems, automatically shut off the main water supply. This capability shifts the paradigm from post-event cleanup to pre-event mitigation, fundamentally altering the calculus of home-related risk.

This integration of sensor-based prevention technology represents a structural overhaul of the home insurance product, moving it from a passive financial guarantee to an active service. For insurance carriers, the primary motivation is the significant improvement of loss ratios, achieved by tangibly reducing both the number of claims filed (frequency) and the average cost of each claim (severity). By preventing small issues from escalating into major disasters, insurers can better manage their financial exposure and maintain profitability in an increasingly volatile market. For policyholders, the advantages extend far beyond potential premium discounts. The greatest value lies in the avoidance of the immense disruption, stress, and emotional toll that accompany a significant property loss. This evolution reframes the insurance contract as a collaborative partnership in protection, where both parties are actively engaged in maintaining the safety and integrity of the home.

The Technology Driving the Change

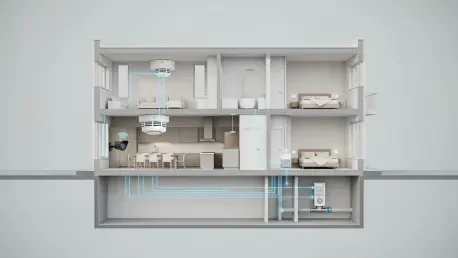

This preventive ecosystem is best understood not as a collection of standalone gadgets but as an integrated network of connected devices that create multiple layers of protection. This holistic approach addresses the most common and costly sources of home insurance claims with sophisticated, interconnected solutions. Water damage mitigation remains a central focus for the industry, as non-weather-related water losses are consistently among the most frequent and expensive claims filed by homeowners. The key technologies in this category include smart water shutoff valves, which can be installed on a home’s main water line and automatically stop the flow of water upon detecting a leak anywhere in the system. These are complemented by whole-home leak detection systems and individual environmental sensors placed in high-risk areas—such as basements, attics, and laundry rooms—that monitor for moisture and freezing temperatures, providing an early warning before pipes can burst. The effectiveness of this network relies on proper installation, consistent connectivity, and proactive homeowner maintenance.

Beyond water damage, the technology ecosystem offers robust solutions for fire prevention and security. Smart smoke and carbon monoxide detectors represent a major leap forward from traditional alarms. These connected devices not only sound an audible alarm but also send instant notifications to homeowners’ mobile devices, regardless of their location. More advanced systems can be integrated with professional monitoring services, ensuring that emergency responders are dispatched immediately, which is critical for limiting property damage and, most importantly, protecting lives. On the security front, a comprehensive apparatus now includes connected security cameras, motion sensors, and door and window sensors that detect unauthorized entry. Smart locks further enhance this by allowing homeowners to manage and monitor access remotely, providing a detailed log of all entries. Together, these systems not only act as a powerful deterrent to theft and vandalism but also supply invaluable video documentation in the event that an incident does occur.

The Impact on Policies and Privacy

Redefining Value and Incentives

The adoption of these sophisticated technologies has a direct and measurable impact on the primary loss drivers that have historically determined homeowners’ insurance pricing. By actively mitigating the risks of fire, water damage, and theft, these interconnected devices fundamentally alter a property’s risk profile, making it a more attractive and less volatile asset for an insurer to cover. Consequently, carriers are increasingly acknowledging this tangible risk reduction in their underwriting processes and pricing models. This recognition has given rise to a new landscape of financial incentives designed to encourage the adoption of preventive technology, though these programs are not yet standardized across the industry. Currently, the approach is one of encouragement rather than a mandatory requirement for coverage, allowing homeowners to proactively enhance their protection and be rewarded for it.

Policyholders who invest in qualifying smart home systems can now access a range of benefits that directly impact their cost of insurance. The most common incentive is a direct premium discount, which can reach up to 15 percent for comprehensive, professionally monitored systems that address multiple perils like fire, water, and security. For those who install individual devices, such as a water leak sensor or a set of connected smoke detectors, smaller policy credits may be applied. Some carriers have also introduced deductible adjustments, offering a lower deductible for claims related to a risk that is being actively monitored by an approved prevention system. These incentives vary widely by carrier, with differing standards for device classification, monitoring requirements, and data-sharing agreements. It is therefore crucial for homeowners to engage in clear discussions with their insurer to verify which devices qualify and to provide the necessary documentation to receive these benefits.

Future Trends and Emerging Challenges

The application of prevention technology has now expanded beyond the confines of individual properties to address risks at a community level, particularly in regions exposed to widespread catastrophes. In areas prone to wildfires, for instance, insurers and communities are collaborating on the deployment of shared sensor networks. These systems monitor environmental conditions such as heat, humidity, and smoke across entire neighborhoods, providing earlier and more accurate warnings than could be achieved with individual home systems alone. This community-level data offers a powerful tool for coordinating more effective evacuation efforts, improving the deployment of emergency response resources, and providing insurers with a far more sophisticated method for evaluating and pricing widespread wildfire risk. This trend marks a significant evolution, demonstrating how aggregated data from connected devices can enhance resilience for entire communities, not just single households.

This rapid expansion of data-generating technology, however, also introduced significant and complex challenges related to data governance, security, and personal privacy. As millions of devices began transmitting a constant stream of sensor readings and video footage, insurers turned to artificial intelligence (AI) to analyze these vast datasets for patterns that could inform underwriting and risk assessment. This development raised critical questions about data retention policies, third-party access, and the potential for algorithmic bias to create unintended discrimination or exclusion. Legal and policy experts highlighted the urgent need for clear industry standards and robust regulatory frameworks to govern how this sensitive data was stored, define its acceptable uses, and provide consumers with transparent opt-out provisions. The successful integration of this technology depended on balancing the immense potential for loss avoidance with the establishment of strong consumer protections.