Imagine a scenario where car insurance premiums aren’t dictated by static details like age or residential area, but instead reflect the very way a driver navigates the roads each day, transforming the industry with personalized pricing. This isn’t a distant dream but a reality powered by telematics, an innovative technology that’s revolutionizing the auto insurance industry. By tracking real-time driving behaviors—such as speed, braking patterns, and even the time of day a vehicle is in use—telematics allows insurers to craft personalized rates that align closely with individual risk profiles. This shift moves away from the traditional one-size-fits-all approach, promising a fairer system where safe driving can directly translate to lower costs. Beyond just savings, telematics encourages accountability on the road, potentially transforming how drivers perceive and approach their daily commutes. As this technology gains traction, it’s reshaping not only premium calculations but also broader safety trends, raising important questions about privacy and equity in the process. This exploration will dive into the mechanics of telematics, its various forms, the benefits it offers, the challenges it poses, and what the future holds for this dynamic intersection of tech and insurance.

Unpacking the Basics of Telematics Technology

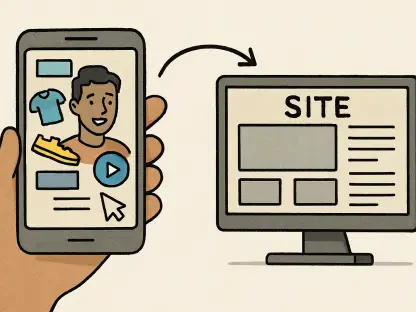

At its heart, telematics represents a fusion of telecommunications and informatics, designed to monitor and analyze driving behavior through sophisticated tech tools. Insurers employ a range of methods to collect data, including smartphone applications, plug-in devices that connect to a car’s diagnostic port, and built-in vehicle systems that transmit information directly. These tools track critical metrics such as speed, acceleration, braking intensity, cornering habits, and even mileage or the times of day a driver is active. The collected data forms a comprehensive picture of a driver’s habits, moving beyond outdated assumptions to a nuanced understanding of risk. This approach marks a significant departure from conventional insurance models that often rely on broad demographics or historical claims data, introducing a layer of precision that aims to reflect reality more accurately.

Once gathered, this data is processed to generate a driving score, a numerical indicator of how safely or riskily someone operates their vehicle. A high score, often associated with cautious habits like steady speeds and gentle braking, can lead to substantial discounts on premiums. Conversely, patterns such as frequent hard stops or driving during high-risk hours, like late at night, might result in higher rates. This dynamic pricing model ensures that premiums aren’t just a static fee but a reflection of actual behavior on the road. Importantly, while traditional factors like location or driver age still hold weight, telematics adds a personalized dimension that seeks to balance fairness with accuracy, potentially benefiting those who prioritize safety in their daily drives.

Exploring Different Telematics Insurance Models

Telematics programs come in varied forms, each tailored to focus on specific aspects of driving behavior or vehicle usage, offering distinct paths to personalized insurance. One prominent model is Pay-as-You-Drive (PAYD), which emphasizes mileage alongside general driving habits. This program often appeals to those who drive less frequently, such as individuals working from home or using public transit for regular commutes. By rewarding lower mileage and safe practices with reduced premiums, PAYD aligns costs with actual vehicle use, providing a straightforward incentive for minimizing time on the road while maintaining careful habits. This model suits drivers looking for a simple, usage-focused way to lower their insurance expenses.

Another approach, known as Pay-How-You-Drive (PHYD), shifts the spotlight to driving style rather than distance traveled. It closely examines behaviors such as sharp turns, sudden acceleration, or abrupt braking, using these metrics to assess risk and adjust rates accordingly. Drivers who consistently demonstrate smooth, controlled handling can benefit from lower premiums, while those with erratic tendencies might face higher costs. Beyond just pricing, PHYD offers a window into personal driving patterns, often revealing areas for improvement. Then there’s Manage-How-You-Drive (MHYD), which builds on PHYD by incorporating real-time feedback mechanisms. Through alerts, scores, or gamified elements like badges, MHYD actively coaches drivers to adopt safer habits over time, fostering a proactive approach to road safety that can lead to sustained premium reductions.

Advantages for Drivers and Insurance Providers

Telematics brings a host of benefits to the table, creating a win-win scenario for both drivers and insurance companies through tailored pricing and enhanced safety. For drivers, the most immediate advantage lies in the potential for significant cost savings. Those who maintain safe habits—such as avoiding excessive speeds or harsh braking—and log fewer miles can see premium reductions ranging from 10% to 25%, depending on the program. Some insurers sweeten the deal with initial sign-up bonuses or ongoing discounts for consistent performance, making participation financially appealing. This personalized approach ensures that responsible drivers aren’t penalized by the risky behaviors of others, aligning costs more closely with individual actions and encouraging a sense of fairness in pricing structures.

Beyond financial incentives, telematics plays a pivotal role in improving road safety by providing actionable feedback on driving habits. Real-time alerts about behaviors like speeding or distracted driving—often linked to phone use—help individuals identify and correct risky patterns before they lead to accidents. Research indicates that nearly half of telematics users show marked improvements in their driving, with a substantial portion sustaining these changes over the long term. For insurers, the technology streamlines operations, particularly in claims processing. Access to precise data at the moment of a crash, including speed and location, facilitates faster fault determination and reduces fraudulent claims. This efficiency proves especially valuable for commercial fleets, where quick resolution and emergency notifications can significantly enhance operational flow and safety protocols.

Navigating Privacy and Data Concerns

While telematics offers clear advantages, it also raises significant concerns about privacy and the handling of personal information, prompting a closer look at data practices. The technology requires extensive data collection, capturing details about where and when a driver travels, alongside specific behaviors behind the wheel. This level of monitoring can feel intrusive, particularly if the information is shared with third parties or retained longer than necessary without explicit consent. High-profile cases of automakers tracking drivers without clear permission have intensified these worries, highlighting the potential for misuse or unauthorized access to sensitive data, which can erode trust in telematics programs and the insurers offering them.

To address these issues, experts advocate for stringent safeguards and transparency in how data is managed within telematics systems. Recommendations include limiting data collection to only what’s essential for assessing risk, employing robust encryption to protect information, and providing clear, accessible policies on storage duration and sharing practices. Regulatory bodies in various states are also stepping in, with some regions imposing strict rules on how behavioral data can be used for pricing, while others mandate detailed disclosures to ensure drivers understand what they’re signing up for. These measures aim to strike a balance between leveraging technology for better insurance models and protecting individual privacy, ensuring that telematics evolves in a way that prioritizes consumer trust alongside innovation.

Identifying Winners and Losers in Usage-Based Insurance

Telematics creates a divide in its impact on drivers, with certain groups reaping rewards while others face potential drawbacks based on their driving profiles. Those who consistently exhibit safe behaviors—such as smooth braking, moderate speeds, and avoiding high-risk hours—often emerge as the primary beneficiaries. Low-mileage drivers, perhaps due to remote work or limited travel needs, also stand to gain significantly, as their reduced road time translates to lower risk scores and, consequently, discounted premiums. These individuals find telematics a refreshing shift, rewarding their caution and lifestyle choices with tangible savings that traditional insurance models might overlook, fostering a sense of equity in how costs are determined.

However, not all drivers fare as well under this data-driven approach, as certain circumstances can lead to higher rates despite a clean claims history. Individuals with irregular schedules, such as night-shift workers, or those with long commutes through heavy traffic, may see their premiums rise due to perceived risk in their driving patterns. Behaviors flagged as risky, like frequent speeding or hard braking—often unavoidable in urban settings—can outweigh other positive factors, disproportionately affecting lower-income drivers who lack flexibility in their routines. This disparity raises questions about fairness, as telematics might inadvertently penalize those whose life circumstances, rather than recklessness, contribute to higher risk scores, underscoring the need for nuanced program design to mitigate such inequities.

Tracking Market Expansion and Emerging Trends

The telematics sector within insurance is experiencing remarkable growth, reflecting a broader shift toward technology-driven solutions in the industry. Valued at billions globally, the market continues to expand at a rapid pace, propelled by the proliferation of connected vehicles and the increasing adoption of smartphone-based tracking systems that lower the barrier to entry for both insurers and drivers. This surge is fueled by a growing consumer willingness to share data in exchange for personalized benefits, alongside advancements that make data collection more seamless and cost-effective. North America and Europe currently lead in adoption, though regions like Asia-Pacific are catching up as connected car infrastructure develops, signaling a global trend toward integrating telematics into standard insurance offerings.

Looking to the horizon, the future of telematics appears poised for even deeper integration with emerging automotive technologies, reshaping how risk is assessed and premiums are calculated. As nearly all new vehicles are expected to feature built-in connectivity in the coming years, telematics could become a default component of insurance policies rather than an opt-in feature. Insurers are increasingly harnessing artificial intelligence to refine risk analysis, paving the way for real-time premium adjustments based on every maneuver a driver makes. This evolution, coupled with the rise of electric and autonomous vehicles, suggests a transformative shift in the insurance landscape, where traditional models may give way to hyper-personalized, behavior-based systems that continuously adapt to individual and technological changes on the road.

Weighing the Path Forward with Telematics

Reflecting on the journey of telematics in auto insurance, it’s evident that this technology has carved a path toward more personalized and equitable pricing by tying premiums to actual driving behaviors. It has delivered notable advantages, from substantial savings for cautious drivers to enhanced safety through immediate feedback, while streamlining claims processes for insurers with precise crash data. Yet, challenges like privacy risks and potential inequities for certain driver groups underscore the need for careful implementation and robust safeguards. The market’s rapid expansion, driven by connected vehicles, hints at a future where telematics becomes integral to insurance norms.

Moving forward, the focus should shift to actionable steps that balance innovation with consumer protection in this evolving field. Drivers contemplating telematics programs are encouraged to thoroughly evaluate their habits and comfort with data sharing, while closely reviewing insurer terms on data usage and rate adjustments. Insurers, on their part, must prioritize transparency and data security to maintain trust, ensuring that benefits like cost savings and safety improvements aren’t overshadowed by privacy concerns. Policymakers could play a pivotal role by harmonizing regulations across regions to address disparities and promote fairness. As telematics continues to shape the industry, fostering collaboration among stakeholders to refine its application will be key to unlocking its full potential for safer roads and fairer premiums.