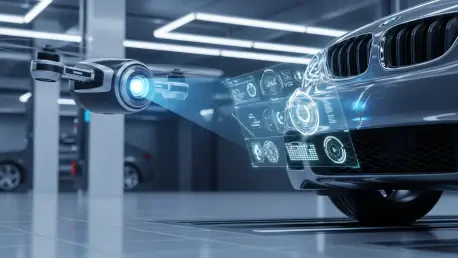

The days of drawn-out insurance claims, buried under mountains of paperwork and fraught with delays, are rapidly drawing to a close, giving way to a new era of immediacy and precision. From lengthy paperwork to instant payouts, the motor insurance claims process is undergoing a radical

Simon Glairy is a recognized expert in the fields of insurance and Insurtech, with a specialized focus on risk management and AI-driven risk assessment. His insights into how large, regulated enterprises adopt new technologies are particularly relevant today. In our conversation, we explore the

The world of smartwatch customization has a new benchmark for excellence. Facer, a leading platform for watch face design, has officially unveiled the winners of its inaugural ‘Facer Awards,’ a landmark event celebrating the most creative, functional, and popular designs of 2025. This celebration

In the dynamic world of digital banking, the lines between traditional financial services are blurring faster than ever. At the forefront of this evolution is Simon Glairy, a leading expert in Insurtech and AI-driven risk assessment. We sat down with Simon to dissect Chase's latest strategic move

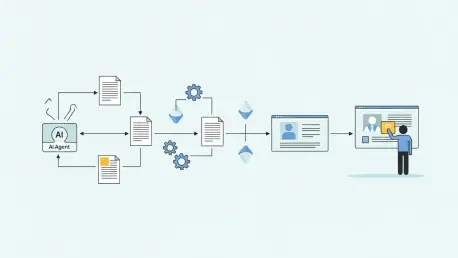

The Excess & Surplus (E&S) insurance market, a sector now valued at nearly $130 billion, has been grappling with a significant challenge born from its own success: record-breaking submission volumes are overwhelming the traditionally manual, paper-based workflows that have defined the industry for

A life insurance policy, long considered a final safety net for loved ones, is now being viewed through an entirely new lens as a tradable asset that can provide a significant cash injection for the living. This shift in perspective is at the heart of a new financial model arriving in the United

Long before a product ever graces a retail shelf, the sheer anticipation of its arrival can send powerful shockwaves through global markets, compelling entire industries to bet their futures on a whisper. The Ripple Before the Wave of Innovation What happens when a tech giant merely hints at a new

A moment of convenience, the simple act of setting down a coat and bags on a kitchen appliance, allegedly ignited a devastating fire that consumed a family's home and claimed the life of their beloved pet. This single, seemingly harmless action has since spiraled into a high-stakes legal battle,

Alabama is confronting a critical economic challenge as soaring liability insurance costs, driven by a surge in litigation, threaten to destabilize businesses and strain household budgets. With liability claims costs jumping an alarming 59% between 2020 and 2024—more than double the rate of

The insurance sector, long anchored by the weight of paper-based processes and manual data entry, is now confronting an operational revolution driven by autonomous, reasoning-based artificial intelligence. This technological shift is not a distant vision but an unfolding reality, challenging the

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy