The immense trust individuals place in insurance agencies, which are custodians of a lifetime's worth of personal, financial, and medical information, has been shaken by a recent cybersecurity incident. Lewis-Watkins-Farmer Agency, Inc., a Texas-based firm operating as Watkins Insurance Group, has

A jarring incident on January 9 in Kishiwada, Osaka, where an unlicensed driver allegedly fled a police stop with an officer clinging to the hood of the vehicle for approximately 700 meters, has rapidly evolved from a local crime report into a significant case study for multiple global industries.

As the insurance industry grapples with the escalating frequency and severity of climate-related disasters, a fundamental shift is underway, moving beyond reactive modeling to proactive, AI-driven risk integration at the very core of underwriting. The traditional approach of assessing climate

As the familiar rhythm of the seasons gives way to longer, more intense periods of extreme heat, the risk of catastrophic fire is no longer a distant threat for a few but an encroaching reality for millions. Major insurers across the nation are now sounding a clear and urgent alarm, compelling

The foundational principles that once made digital risk a manageable, insurable commodity are now being systematically dismantled by the relentless advance of artificial intelligence-powered cyberattacks. What the industry is currently facing is not merely an incremental increase in threat

The United States insurance distribution technology market is currently undergoing a monumental transformation, with projections indicating its valuation will skyrocket from approximately $20.44 billion to an impressive $50.70 billion by 2029. This meteoric rise, marked by a compound annual growth

A New Era of Pricing Intelligence Why This Acquisition Matters In an industry defined by intense competition and complex regulatory oversight, the speed and accuracy of insurance pricing are paramount. The recent acquisition of Matrisk by InsurTech leader Akur8 marks a pivotal moment, signaling a

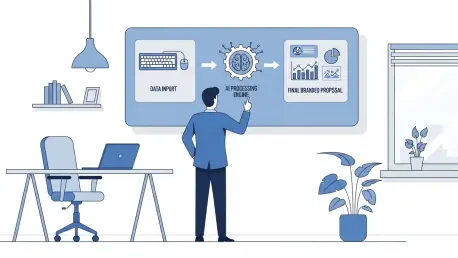

The traditional path to creating a commercial insurance proposal is paved with countless hours of administrative labor, a bottleneck that has long stifled growth and frustrated brokers across the industry. This manual process has historically diverted attention from client engagement and new

The deliberate targeting of essential service vehicles, such as the homeless outreach buses recently set ablaze in Berlin, sends a chilling message that transcends the immediate physical damage, exposing the fragile intersection of urban security, operational continuity, and financial stability for

The digital landscape for British businesses underwent a dramatic and costly transformation in 2024, as the frequency of cyber insurance claims surged to unprecedented levels, signaling a fundamental shift in corporate risk management. This alarming escalation, which saw claims triple compared to

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy