In the competitive digital insurance sector, the silent drag of capital trapped within antiquated, manual claims funding processes often acts as a significant impediment to both growth and innovation. For many firms, this operational friction not only slows down payments but also obscures financial

The Cloud Conundrum When Your Digital Backbone Breaks Will Your Policy Pay Recent major outages across platforms like AWS and Microsoft Azure sent shockwaves through critical industries, grinding aviation, banking, and healthcare to a halt. This digital paralysis exposed a frightening reality: deep

The latest annual report from the Bermuda Health Council reveals a complex and evolving landscape of employer health insurance compliance, where significant enforcement successes are juxtaposed with a troubling increase in the number of employees affected by coverage lapses. While the Council's

In the increasingly complex landscape of modern commerce, a fundamental question is reshaping the relationship between businesses and their insurance carriers: is the insurer a strategic partner invested in long-term success, or merely an inspector focused on rigid compliance checklists? The

In the rapidly evolving landscape of artificial intelligence, the line between real and synthetic media is blurring at an alarming rate. With the launch of models like Nano Banana Pro, the tells that once gave away deepfakes—malformed hands, nonsensical text—are vanishing, creating unprecedented

The Japan Meteorological Agency has issued an unprecedented "megaquake" advisory for the country's northern region, an action precipitated by a disturbing series of seismic events that has placed communities from near Tokyo to the island of Hokkaido on exceptionally high alert. This rare

The modern insurance landscape is grappling with an unprecedented scalability crisis, fueled by a surge in claim volumes that consistently outpaces the availability of seasoned claims adjusters and heightened consumer expectations for rapid and accurate service. In response to this pressing

In a world saturated with digital distractions and notifications, the fleeting brilliance of a great idea or the urgency of a forgotten task can vanish in an instant, lost to the relentless pace of modern life. The challenge of reliably capturing these transient thoughts has led to a market flooded

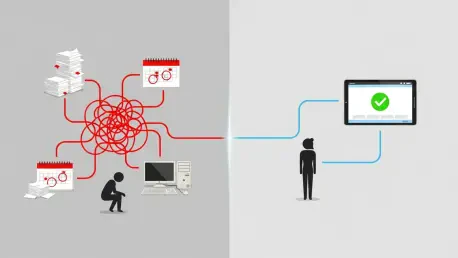

In the relentless pursuit of national expansion, many insurance organizations are unknowingly anchored by an invisible drag on their growth: an outdated and manual approach to producer licensing. This is not merely an administrative inconvenience; it represents a significant operational risk that

Imagine a bustling hotel in the heart of London, once thriving with guests, now teetering on the edge of insolvency as operating costs skyrocket and unexpected risks loom large. This scenario is becoming all too common across the UK hospitality sector, where businesses like hotels and upscale

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy