The modern global marketplace is no longer a landscape of predictable expansion but a high-stakes arena where a single diplomatic shift can dismantle decades of supply chain optimization in hours. As 2026 progresses, multinational corporations find themselves at a crossroads, facing a reality where

Simon Glairy is a prominent figure in the insurance landscape, known for his deep understanding of how emerging technologies reshape risk management and operational frameworks. As the industry pivots toward a more digitized, data-driven future, his insights into large-scale infrastructure projects

The traditional landscape of insurance claims is undergoing a massive transformation as financial institutions prioritize human-centric digital solutions over antiquated manual processes. In an era where consumers expect instant gratification in banking and retail, the insurance claims process has

The modern corporate risk environment has shifted so fundamentally that a single technical glitch in a server room can now spark a global financial crisis, yet many insurance policies still operate as if these worlds are entirely separate. This persistent fragmentation is the primary target for

The integration of specialized large language models into wearable technology has fundamentally transformed how physiological data is interpreted by shifting from generic alerts to clinically validated, person-centric insights. This evolution signals the end of the "black box" era of health

Every time a commercial driver pulls onto the interstate, they are entering a high-stakes environment where the greatest threat often stems from the financial negligence of others sharing the road. While fleet managers invest heavily in top-tier maintenance and driver training, they cannot control

For generations, the success of a family in the Ecuadorian countryside depended entirely on the unpredictable whims of the sky, where one storm could erase years of labor. The recent launch of the nation’s first parametric agricultural insurance program marks a pivotal shift from reactive aid to

While the convenience of checking a wrist-based notification has become a modern standard, the true value of a wearable device lies in its ability to seamlessly integrate into a user's biological rhythms without demanding constant attention at a charging station. The wearable technology industry

For decades, the vaulted halls of the Lloyd’s of London market relied on leather-bound ledgers and hand-shaked agreements, but a silent revolution is currently replacing ink with algorithms to redefine how risk is managed on a global scale. This digital transformation within insurance brokerage

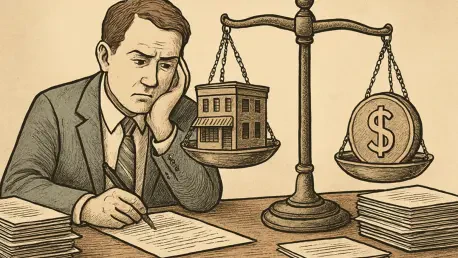

The traditional landscape of commercial underwriting has long suffered from a persistent economic paradox where the cost of human labor frequently outstrips the total value of the small business policies being processed. For decades, legacy carriers have grappled with the "small premium hurdle," a

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy