The rapid democratization of artificial intelligence has unleashed a formidable new weapon for cybercriminals, with hyper-realistic deepfake technology now capable of flawlessly impersonating senior executives to orchestrate massive financial fraud. This sophisticated evolution of social

The constant churn of leadership can destabilize even the most resilient companies, a challenge Covéa UK now confronts as it welcomes its third chief executive in just eighteen months. This rapid turnover at the top has raised questions across the industry about the insurer’s direction and internal

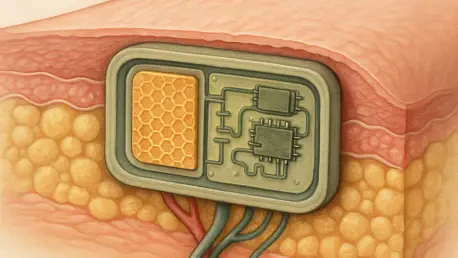

The path to recovering from significant muscle trauma has long been fraught with challenges, often requiring multiple surgeries and leaving patients vulnerable to infection or long-term complications. The development of self-powered biodegradable implants represents a significant advancement in

The insurance industry's journey with artificial intelligence has reached a pivotal inflection point, moving beyond the initial promise of complete automation to embrace a far more nuanced and powerful collaborative model. The initial vision of algorithms single-handedly managing the complexities

In a significant move poised to reshape the enterprise security landscape, AI-native cybersecurity startup Vega Security has successfully closed a $120 million Series B funding round. This substantial capital injection, led by venture capital giant Accel, signals a growing investor and market

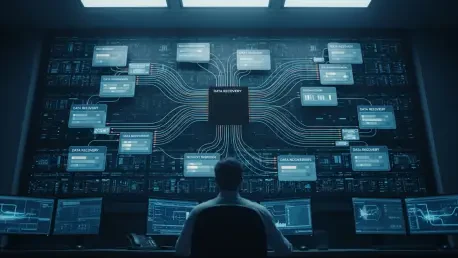

The frantic early morning call from the IT department confirms a local council's worst fears: every file, from sensitive social care records to council tax data, is encrypted and inaccessible, held hostage by a faceless criminal gang demanding a seven-figure sum for its return. Until recently, a

The convergence of artificial intelligence with personal health monitoring has catalyzed a new era where understanding the intricate language of our metabolism is no longer confined to clinical settings. This review explores the evolution of AI-driven metabolic tracking, dissecting its core

In the fiercely competitive global insurance market, where strategic advantage is measured in billions, securing substantial capital is not just a goal but a fundamental necessity for survival and dominance. Global insurance intermediary Howden Group has decisively answered this challenge,

The silent, invisible threat of carbon monoxide has once again been thrust into the public consciousness following a tragic incident in Marion County that resulted in the deaths of two adults and two children, forcing a renewed and urgent examination of detector regulations, state building codes,

After a year of unprecedented quiet in the United Kingdom's insurance distribution sector, a sudden surge in merger and acquisition activity at the start of 2026 has captured the market's attention, raising a critical question about its sustainability. Following a year that saw deal-making fall to

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy