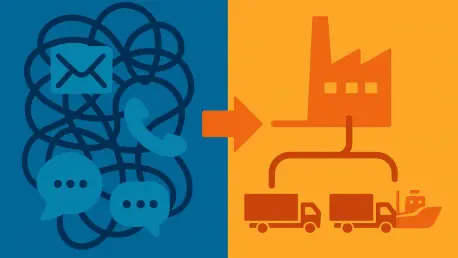

We are joined today by Simon Glairy, a distinguished expert in risk management and the application of AI in complex industries. Global trade, a system vital to our economy, remarkably still operates on a fragmented network of emails, messages, and phone calls. We will explore how new agentic AI

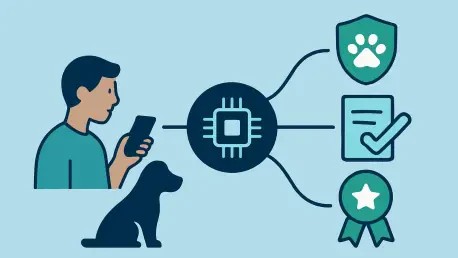

The pet insurance landscape, long characterized by reactive policies and minimal customer engagement, is being fundamentally reshaped by a new generation of technology-driven innovators. At the forefront of this transformation is Lassie, a Stockholm-founded InsurTech company that just secured a

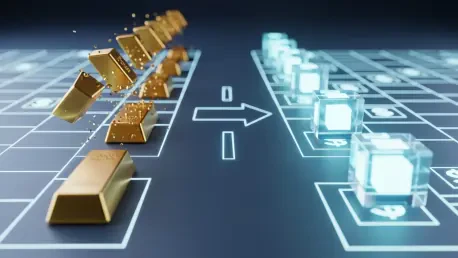

With a distinguished career in risk management and a sharp focus on AI-driven financial solutions, Simon Glairy has become a leading voice at the intersection of insurance and technology. As traditional institutions begin to embrace the transformative potential of blockchain, we sat down with him

The rapid democratization of artificial intelligence has unleashed a formidable new weapon for cybercriminals, with hyper-realistic deepfake technology now capable of flawlessly impersonating senior executives to orchestrate massive financial fraud. This sophisticated evolution of social

The constant churn of leadership can destabilize even the most resilient companies, a challenge Covéa UK now confronts as it welcomes its third chief executive in just eighteen months. This rapid turnover at the top has raised questions across the industry about the insurer’s direction and internal

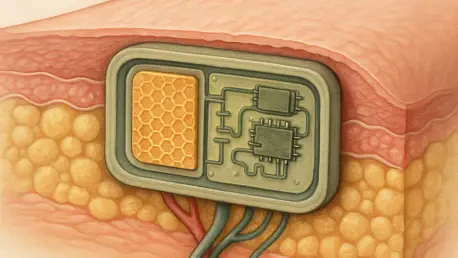

The path to recovering from significant muscle trauma has long been fraught with challenges, often requiring multiple surgeries and leaving patients vulnerable to infection or long-term complications. The development of self-powered biodegradable implants represents a significant advancement in

The insurance industry's journey with artificial intelligence has reached a pivotal inflection point, moving beyond the initial promise of complete automation to embrace a far more nuanced and powerful collaborative model. The initial vision of algorithms single-handedly managing the complexities

In a significant move poised to reshape the enterprise security landscape, AI-native cybersecurity startup Vega Security has successfully closed a $120 million Series B funding round. This substantial capital injection, led by venture capital giant Accel, signals a growing investor and market

The frantic early morning call from the IT department confirms a local council's worst fears: every file, from sensitive social care records to council tax data, is encrypted and inaccessible, held hostage by a faceless criminal gang demanding a seven-figure sum for its return. Until recently, a

The convergence of artificial intelligence with personal health monitoring has catalyzed a new era where understanding the intricate language of our metabolism is no longer confined to clinical settings. This review explores the evolution of AI-driven metabolic tracking, dissecting its core

ITCurated uses cookies to personalize your experience on our website. By continuing to use this site, you agree to our Cookie Policy