Beyond Business as Usual: Why Outage Coverage Demands a New Approach In an increasingly connected world, a power outage is a catastrophic event that can bring a business to a grinding halt. With grid instability and climate-related disruptions on the rise, the financial toll is staggering, costing

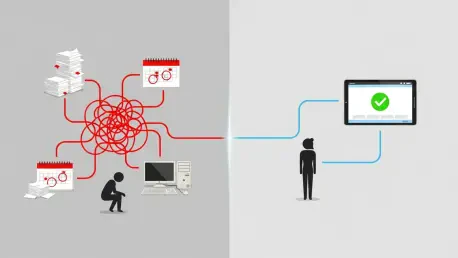

In the relentless pursuit of national expansion, many insurance organizations are unknowingly anchored by an invisible drag on their growth: an outdated and manual approach to producer licensing. This is not merely an administrative inconvenience; it represents a significant operational risk that

In the high-stakes world of specialty insurance where complex risks require bespoke solutions, the placement process has long been defined by a protracted series of manual negotiations and administrative hurdles. This traditional approach, while thorough, creates significant friction, delaying

The insurance industry's legal departments are undergoing a profound transformation, moving away from traditional, labor-intensive workflows toward a more agile and data-driven operational model that is reshaping the very foundation of legal practice. By strategically integrating artificial

Imagine a world where insurance and pension systems seamlessly adapt to complex regulations across continents, delivering cutting-edge digital experiences to millions of policyholders. This vision is inching closer to reality with a significant move in the insurtech realm. Keylane, a prominent

Allow me to introduce Simon Glairy, a leading voice in the insurance and Insurtech arenas, renowned for his deep expertise in risk management and AI-driven solutions. With a career dedicated to navigating the intersection of technology and insurance, Simon has been at the forefront of addressing