For countless homeowners with properties that defy the standard checkboxes—from unique construction materials to a past history of subsidence—the search for insurance has long been a frustrating journey into a digital dead end. In a world where nearly every service is available with a few clicks,

The once-distinct boundaries separating telecommunications from financial services are dissolving at an unprecedented rate, creating a new landscape where your mobile provider is just as likely to offer you car insurance as a new data plan. This industry-blurring trend has reached a new milestone

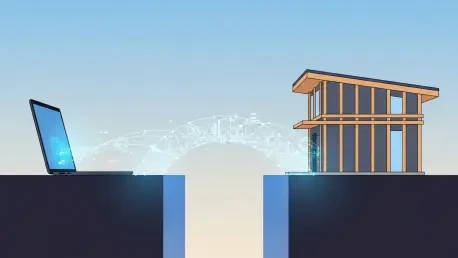

In the competitive digital insurance sector, the silent drag of capital trapped within antiquated, manual claims funding processes often acts as a significant impediment to both growth and innovation. For many firms, this operational friction not only slows down payments but also obscures financial

With over two decades of experience spanning traditional insurance giants and agile Insurtech startups, Simon Glairy has a unique vantage point on the industry's evolution. His expertise in AI-driven risk assessment and digital transformation makes him the ideal voice to deconstruct one of the

For any dedicated photographer, the moment a sudden downpour begins or an accidental drop occurs is a heart-stopping experience, as the high cost of cameras, lenses, and accessories flashes before their eyes. Many assume their manufacturer's warranty offers a safety net, only to discover too late

The traditionally paper-intensive and often cumbersome process of securing motor insurance in Kuwait is facing an unprecedented digital challenger, not from a legacy insurer, but from an unexpected player in the nation's telecommunications sector. The launch of Zain Insure, a fully digital platform