The insurance industry stands at a critical juncture, caught between the immense pressure to innovate and the monumental risk associated with overhauling the legacy core systems that have been the bedrock of their operations for decades. For many carriers, the prospect of a full "rip-and-replace"

The viral video of a chief executive making inflammatory statements can now be created and disseminated in a matter of hours, potentially erasing millions in market value before the truth can even begin to surface. As artificial intelligence continues its rapid advance, the weaponization of

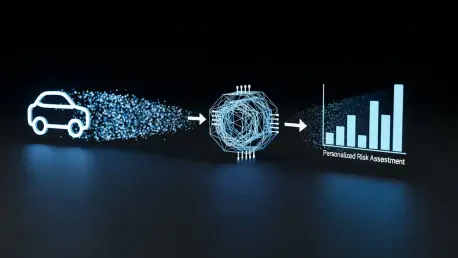

The traditional, often lengthy process of filing a car insurance claim, characterized by extensive paperwork and prolonged waits for adjusters, is rapidly becoming a relic of the past as technology reshapes the industry from the ground up. At the forefront of this revolution is artificial

While public discourse on Artificial Intelligence governance often centers on government regulation and corporate ethics boards, a far more immediate and powerful shaping force is quietly at work within the intricate mechanisms of the global insurance market. Far from its traditional perception as

In an industry defined by risk assessment and long-term stability, the greatest threat to the future of insurance may not be market volatility or catastrophic events, but the very culture that has sustained it for centuries. Despite significant investments in cutting-edge technology, many insurers

The silent revolution brewing within the insurance industry is no longer a distant forecast but an immediate reality, compelling even the most entrenched institutions to fundamentally reconsider their operational playbooks or risk obsolescence. While other sectors have loudly proclaimed their