The New Frontier of Climate Resilience As climate volatility intensifies, driving a surge in the frequency and severity of natural catastrophes, industries from insurance to banking are grappling with unprecedented levels of risk. The traditional models used to predict and manage these events are

In an industry defined by risk assessment and long-term stability, the greatest threat to the future of insurance may not be market volatility or catastrophic events, but the very culture that has sustained it for centuries. Despite significant investments in cutting-edge technology, many insurers

The silent revolution brewing within the insurance industry is no longer a distant forecast but an immediate reality, compelling even the most entrenched institutions to fundamentally reconsider their operational playbooks or risk obsolescence. While other sectors have loudly proclaimed their

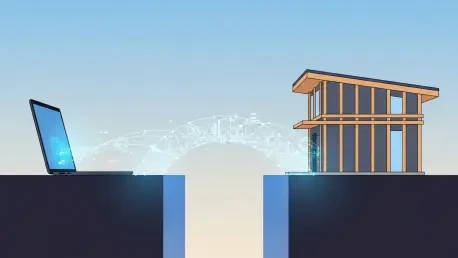

For countless homeowners with properties that defy the standard checkboxes—from unique construction materials to a past history of subsidence—the search for insurance has long been a frustrating journey into a digital dead end. In a world where nearly every service is available with a few clicks,

Beneath the surface of daily market fluctuations, a fundamental reshaping of the UK insurance industry is quietly underway, with leading firms moving beyond incremental changes to redefine their core strategies for long-term success. Beyond the Headlines: Decoding the New Blueprint for UK Insurance

In a landmark event that may well be remembered as a turning point for Nigeria's financial services landscape, the nation's insurance industry recently gathered not merely to witness technological presentations but to collectively chart a new course for its future. The 2025 Nigerian Insurers