A sweeping legislative overhaul has taken effect across Georgia, fundamentally altering the regulatory landscape for individuals and industries by introducing a comprehensive suite of laws aimed at modernizing state functions, enhancing consumer protections, and reshaping judicial and electoral

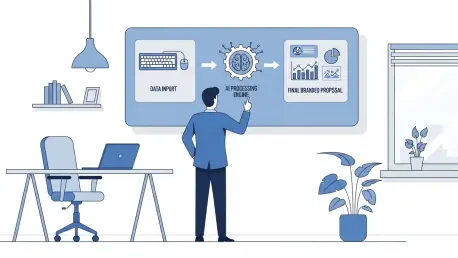

The traditional path to creating a commercial insurance proposal is paved with countless hours of administrative labor, a bottleneck that has long stifled growth and frustrated brokers across the industry. This manual process has historically diverted attention from client engagement and new

The deliberate targeting of essential service vehicles, such as the homeless outreach buses recently set ablaze in Berlin, sends a chilling message that transcends the immediate physical damage, exposing the fragile intersection of urban security, operational continuity, and financial stability for

The digital landscape for British businesses underwent a dramatic and costly transformation in 2024, as the frequency of cyber insurance claims surged to unprecedented levels, signaling a fundamental shift in corporate risk management. This alarming escalation, which saw claims triple compared to

A significant legislative shift has taken root across Florida as of January 1, 2026, introducing a suite of new laws designed to reshape the landscape of consumer rights, healthcare access, and animal welfare. These regulations move beyond minor adjustments, representing a concerted effort to

The quiet hum of servers on a holiday weekend can be a deceptive sound, as it often masks a period of heightened vulnerability when cybercriminals are most active. While staff and security teams operate with reduced capacity, threat actors capitalize on the slower response times to launch