In a world increasingly battered by the relentless forces of climate change, the insurance industry faces an unprecedented challenge to adapt and innovate, with Neptune Insurance emerging as a potential leader through its upcoming initial public offering in the United States. As hurricanes grow

In an era where critical infrastructure faces unprecedented challenges from cyber threats to climate change, the ability to safeguard assets and ensure financial stability has never been more vital. A European organization operating in this sector recently embarked on a transformative journey to

In today’s fast-evolving insurance industry, where operational expenses can quickly spiral out of control due to intricate claims processes, stringent regulations, and rising customer expectations, finding ways to reduce costs without compromising quality is a top priority. Outsourcing has emerged

In a world increasingly shaped by climate unpredictability and technological breakthroughs, the insurance industry stands at a pivotal crossroads, with innovative players like Neptune Insurance leading the charge. This flood-focused InsurTech company recently filed for a U.S. IPO, marking a

In an era where digital infrastructure underpins nearly every facet of global commerce and communication, the cyber insurance industry faces an unprecedented challenge in predicting and preparing for catastrophic cyberattacks that could cripple economies overnight. Unlike traditional insurance

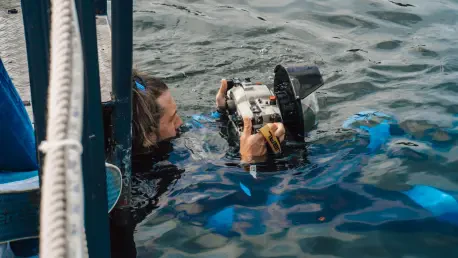

In an era where the risk and insurance industry faces unprecedented shifts, one name stands out as a potential harbinger of future trends: Ben Wyatt, Head of Marine, U.S. at Berkshire Hathaway Specialty Insurance (BHSI). With marine insurance evolving beyond its traditional maritime roots to