A sprawling data security incident involving Sentinel Security Life Insurance Co. (SSL) and Atlantic Coast Life Insurance Company (ACL) has potentially exposed the highly sensitive personal and medical information of an unknown number of policyholders, beneficiaries, and other affiliated

The digital landscape for British businesses underwent a dramatic and costly transformation in 2024, as the frequency of cyber insurance claims surged to unprecedented levels, signaling a fundamental shift in corporate risk management. This alarming escalation, which saw claims triple compared to

A significant legislative shift has taken root across Florida as of January 1, 2026, introducing a suite of new laws designed to reshape the landscape of consumer rights, healthcare access, and animal welfare. These regulations move beyond minor adjustments, representing a concerted effort to

In a significant pivot that reflects the mounting economic pressures on businesses across the United States, employers are now placing a higher premium on controlling employee benefit costs than on using those same benefits as a tool for attracting and retaining top talent. An annual analysis of

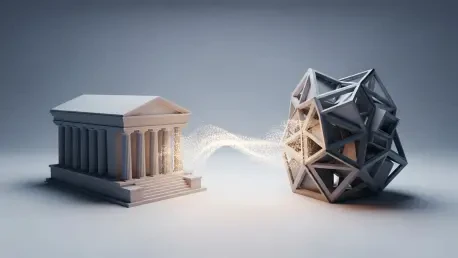

The Dawn of a New Financial Alliance A profound and rapidly accelerating convergence is underway between the worlds of alternative asset management and life insurance. This is not a subtle, incremental change but a seismic shift driven by powerful mutual interests, fundamentally altering how life

The quiet hum of servers on a holiday weekend can be a deceptive sound, as it often masks a period of heightened vulnerability when cybercriminals are most active. While staff and security teams operate with reduced capacity, threat actors capitalize on the slower response times to launch